Cameroon’s real estate market is growing fast, attracting both the Cameroonian diaspora and global investors. But one common question remains: can foreigners buy property in Cameroon? The answer is yes—but with important legal considerations. This guide walks you through the process and explains what international investors and Cameroonians in the diaspora need to know about property ownership laws in, leasehold property options, and real estate investment opportunities, especially in cities like Limbe before buying property in Cameroon.

Understanding Property Ownership Laws in Cameroon

Foreigners can legally purchase and own real estate in Cameroon. However, property ownership laws in Cameroon make a clear distinction between owning buildings and owning land.

- Foreigners can own buildings: These include houses, apartments, and commercial properties.

- Land ownership is restricted: Foreign nationals cannot own land outright. Instead, land is made available through leasehold property in Cameroon, which provides long-term security.

- Leasehold arrangements typically last between 30 to 99 years and are renewable.

This framework ensures that real estate investment in Cameroon for foreigners is both possible and secure when properly managed.

These policies apply regardless of your country of origin, meaning that whether you are German, American, or Nigerian, the same legal procedures apply when acquiring property.

Can Cameroonians Who Gave Up Citizenship or Foreigners Buy Property in Cameroon?

A common question among the diaspora is: Can Cameroonians who have given up their citizenship still buy land in Cameroon? The answer depends on your current legal status.

Cameroon does not officially allow dual nationality, so former citizens who have naturalized elsewhere are generally considered foreigners.

Nevertheless, Cameroon property guides for the diaspora recommend exploring bilateral treaties or specific legal channels that may offer advantages. For this reason, consulting a qualified real estate lawyer in Cameroon is essential for tailored advice.

Steps to Buying Property in Cameroon as a Foreigner

Navigating the Cameroonian real estate market as a non-citizen involves several steps. At CFB Holding, we help you through each phase to ensure a smooth and transparent process.

1. Choose a Property and Conduct Due Diligence

- Verify the property’s legal status with the Land Registry.

- Conduct a Property Title Search to confirm ownership and ensure no legal disputes exist.

2. Engage a Real Estate Lawyer

- Ensures all transactions comply with property ownership laws in Cameroon.

- Prevents legal pitfalls and fraudulent activities.

3. Sign a Sale Agreement

- A legally binding contract is drafted and signed by both parties.

4. Secure a Leasehold for Land Purchases

- For land transactions, a leasehold agreement is negotiated with the government.

5. Obtain Necessary Approvals

- Approval from the Ministry of State Property and Land Tenure (MINDCAF) is typically required, and we facilitate this process.

6. Register the Property

- Complete payment and officially register the property with the Land Registry.

7. Pay Required Taxes and Fees

- Transfer Tax: 2% of property value (paid by buyer).

- Notary Fees: 0.5% to 4% depending on the property.

- Annual Property Tax: 0.1% of the assessed value.

These steps are standard for how to buy property in Cameroon as a foreigner, regardless of your country of origin.

CFB Holding can facilitate all these steps for customers, ensuring a seamless and hassle-free real estate acquisition process:

- Choose a Property and Conduct Due Diligence

- Verify the property’s legal status with the Land Registry.

- Conduct a Property Title Search to confirm ownership and ensure no legal disputes exist.

- Engage a Real Estate Lawyer

- Our legal experts ensure compliance with Cameroonian property laws and prevent fraud.

- Sign a Sale Agreement

- Once satisfied with the property status, a legally binding Sale Agreement is drafted and signed.

- Secure a Leasehold (for Land Purchases)

- If acquiring land, we handle the leasehold agreement arrangement with the government.

- Obtain Necessary Approvals

- Approval from the Ministry of State Property and Land Tenure (MINDCAF) is typically required, and we oversee this process.

- Complete Payment and Register the Property

- We assist in making the final payment and ensuring ownership is transferred through the Land Registry.

- Pay Required Taxes and Fees

- Property Tax: 0.1% of property value (annually)

- Transfer Tax: 2% of property value (paid by buyer)

- Notary Fees: 0.5% to 4% of property value

Modern Apartments for Sale in Cameroon – Hassle-Free Ownership

For those looking to bypass land complexities, CFB Holding offers modern apartments for sale in Limbe, Cameroon. Apartments come with titled ownership, simplifying the process for both foreign and diaspora investors. This is an ideal solution for individuals asking how real estate for Cameroonian diaspora can be streamlined as it eliminates the need for leasehold arrangements, making the purchase process even more straightforward for foreign investors and members of the diaspora.

Does Real Estate Investment in Cameroon Grant Residency to Foreigners?

Another frequent question is whether buying land in Cameroon as a non-citizen can lead to permanent residency. Unfortunately, Cameroon does not currently offer Golden Visa or automatic residency programs through real estate investment.

However, there are other pathways:

- Business investment: Registering and running a company in Cameroon.

- Employment sponsorship: Being hired by a local company.

- Family reunification: Sponsored residency by close family members.

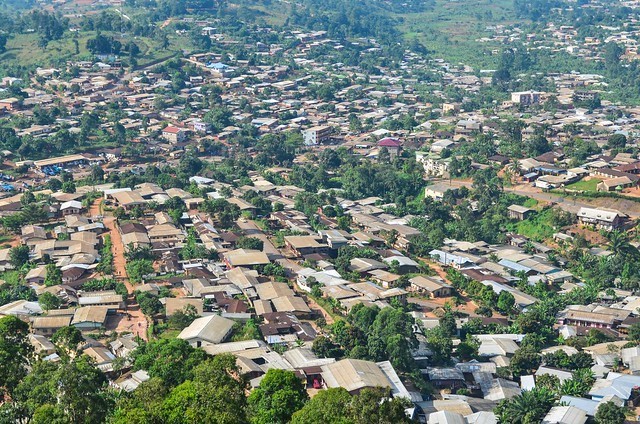

Why Invest in Limbe – A Hotspot for Foreign Real Estate Investors in Cameroon

Limbe has become a hotspot for foreign real estate investors, and with good reason. Here’s why investing here makes sense:

- Coastal charm: Black sand beaches and proximity to Mount Cameroon.

- Tourism growth: Rising holiday rental and hospitality potential.

- Modern infrastructure: Road access, electricity, water, and internet connectivity.

- Stable and Secure environment: A peaceful and welcoming community.

CFB Holding’s Elysian Heights Limbe gated community is a shining example of what modern urban planning looks like in Cameroon. This exclusive estate is perfect for those seeking Cameroon real estate for international investors.

Final Thoughts: Investing in Your Future

Whether you’re a member of the Cameroonian diaspora or an international investor, Cameroon presents exciting opportunities in real estate. With the right knowledge and guidance, owning property in Cameroon is a secure and profitable venture.

Elysian Heights, developed by CFB Holding, offers a unique and high-value real estate opportunity in Limbe. Our team is here to assist you in navigating the legal framework and making informed investment decisions.

Final Thoughts: Can Foreigners Securely Buy Property in Cameroon?

So, can foreigners buy property in Cameroon? Absolutely. With the right guidance and legal support, owning a home or apartment in Cameroon is both safe and profitable. Whether you’re a member of the diaspora or an international investor, now is the time to explore modern real estate investment opportunities.

At CFB Holding, we specialize in helping you invest with confidence. Explore apartments for sale in Limbe, Cameroon, or secure a leasehold property in Cameroon at Elysian Heights Residential Estate tailored to your needs.

Contact us today to start your journey into Cameroonian real estate!